Forex robots (Expert Advisors)

Can Robots make Money?

There are many hundreds of Forex robots (Expert Advisors) available on the marketplace today – and every day new ones are being added. Everyone claims to be the best, the first with a new technology, and all kinds of “proofs” are published in support of their amazing profitability. It is utterly confusing to the newbie and he/she will buy many robots thinking that they will now sit back and get rich, with all too often being bitterly disappointed. For some strange reason, the robot does not perform as the vendor has claimed and is LOSING money! Soon they realise that more money is made selling robots than the robots are making themselves. After a while, they start to wonder if ANY robots in the world can make money, and if so where can one find them?

Critical Issues

Well, we believe that there are a few Forex Robots (Expert Advisors) on the market that can make money. But there are a few critical issues to be considered that can make a big difference in the performance of a robot. Here are some of the most important issues:

Some Forex robots are released with great fanfare and actually is profitable at the start but then fizzles out as the market changes (FapTurbo comes to mind). Lesson: Look for robots that is continually updated and optimized by the vendor so that it stays profitable over time as the market changes.

Execution Speed

Scalping robots are extremely sensitive to the size of spreads and execution speed and will differ greatly in performance between different brokers. If you buy a scalping robot make sure that you choose a broker with razor-thin spreads and fast execution speed. Perhaps use a VPS service that is closely situated to the broker’s operational offices.

Profit and Loss Ratio

Some Forex robots are sold with an impressive record of having over 90% profitable transactions. You must not be fooled by that. Find out what the Stop Losses are that is used in the robot. It is not uncommon to find those types of robots with Stop Losses of 300 – 1000+ pips! That means you may have 10 – 20 wins in a row and then get all your profit wiped out in one loss. So you may even be profitable over several months and then the next month lose everything you have gained.

If you hit this Stop Loss at the beginning, or God forbid two in a row, you may lose the bigger portion of your equity and be in a serious loss situation right from the start. Even with smaller StopLosses, it is important to find out what the ratio between the Profit Take and the Stop Loss is. E.g. the Stop Loss for the EURUSD pair in Fapturbo is 50 pips but the Profit Take is only 5 pips. That means that you can have 10 wins in a row and just one loss and then still lose money because of the broker’s commission and/or spread. That is a 91% win ratio and you still lose money!

Small number of transactions

Other robots come with a good record, but they may make only small profits or few transactions and you are not getting ahead. Either the average profits it makes are very small, or more importantly it makes only a small number of transactions per month. If your robot makes only one or two transactions per week or less, it must make a large profit in one transaction to be worthwhile. There are robots like that – normally operating on higher timeframes like the 4Hour or Daily timeframes.

Size and nature of the lots

A very important factor that determines the profitability of robots is the size and nature of the lots used in each transaction. Here we have a situation that if you want higher profits you will have to take a higher risk. The two are correlated. If, for example, you put a standard lot of say 0.1 on every transaction you will have less risk, but also not very exciting profits. But if you rather use a percentage of your equity – say 1 – 3% on every transaction – your profits can grow exponentially over time.

Optimal parameters

Another critical factor that determines the profitability of robots is that of setting the optimal parameters. Just a slight difference in certain of the parameters in some robots can make a huge difference in their profitability. Here a knowledge of how to optimize robots as taught in our courses can be of great help in identifying the correct parameters. Unfortunately optimising parameters normally leads to “curve fitting”. As soon as the market changes the robot loses its profitability since the optimised parameters were only profitable for a particular price movement. We know that the nature of price movement changes all the time. So the best would be to find general parameter settings thatworks most of the time e.g. MACD (12, 26. 9) or RSI (14)

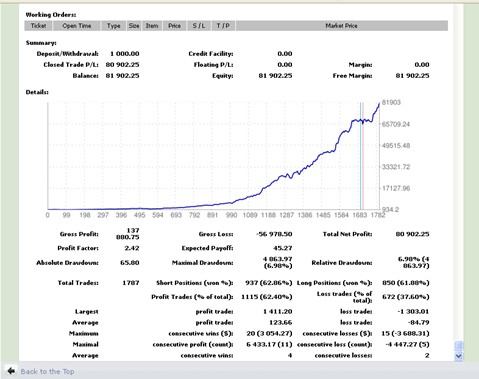

Here is what the performance can be according to an account run by the vendor and publicized in some Forex websites:

Extraordinary Performance

Quite extraordinary performance would you not say? So why are some people losing money with this robot?

Well, this is one of those sensitive scalping robots, with very small stop losses and profit takes of only a couple of pips at a time. If run with the wrong broker it can lose money, but on the other hand if in the right environment, it will be profitable. The power of this robot lies in the high number of transactions it does every day. I also has a low risk level as can be seen from its very low maximal drawdown of less than 7%. That is because it features very tight stop losses of only a couple of pips per transaction.

Robots can be Profitable

Maybe this robot’s biggest drawback is its popularity and therefore its over-population at certain brokers. That together with its profitability can force certain brokers to put some artificial delays on transactions which kills its profitability. But if the right approach is taken this robot can be profitable.

E-mail: [email protected]